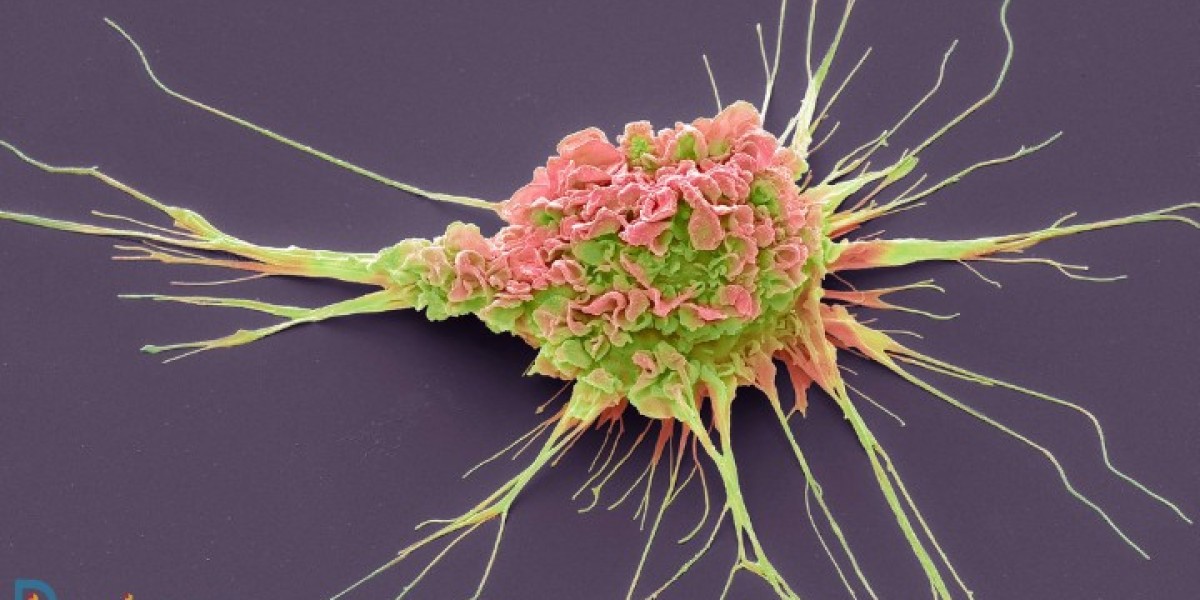

The Current Landscape of Multiple Myeloma Treatments

Multiple myeloma treatment options have expanded significantly, thanks to breakthroughs in various drug classes, including:

Proteasome Inhibitors: Target and disrupt protein degradation in cancer cells.

Immunomodulatory Drugs (IMiDs): Enhance the immune response against cancer cells.

Monoclonal Antibodies: Specifically target cancer cells to facilitate immune response.

CAR-T Cell Therapies: Genetically modify a patient’s T-cells to attack myeloma cells.

As the prevalence of multiple myeloma continues to rise, particularly among the aging population, the demand for effective treatments has never been higher. This scenario creates a competitive environment where innovation is key to gaining market share.

Bristol Myers Squibb: A Legacy of Leadership and Innovation

BMS has established itself as a leader in the oncology space, particularly with its flagship drug Revlimid (lenalidomide). This immunomodulatory agent has played a crucial role in treating multiple myeloma, resulting in extended survival rates and improved quality of life for patients.

In addition to Revlimid, BMS is making significant investments in research and development, focusing on cutting-edge therapies such as:

Abecma (idecabtagene vicleucel): This CAR-T therapy has shown remarkable efficacy in patients with relapsed or refractory multiple myeloma, setting a new standard in treatment.

Empliciti (elotuzumab): A monoclonal antibody that enhances the immune system’s ability to recognize and attack myeloma cells, providing a vital tool in combination therapies.

Idecabtagene Vicleucel: Another promising CAR-T therapy targeting BCMA (B-cell maturation antigen), currently undergoing extensive clinical trials.

BMS's robust pipeline demonstrates its commitment to addressing unmet medical needs and enhancing patient outcomes through innovative treatments.

Janssen Pharmaceuticals: A Force for Change

Janssen, a subsidiary of Johnson & Johnson, has become a powerhouse in the multiple myeloma market with a portfolio that includes several groundbreaking therapies. Notable products from Janssen include:

Darzalex (daratumumab): This pioneering monoclonal antibody targets CD38, significantly improving survival rates for patients and establishing itself as a key component in multiple myeloma treatment regimens.

Ninlaro (ixazomib): An oral proteasome inhibitor that offers convenience and flexibility in treatment options for patients.

Carvykti (ciltacabtagene autoleucel): Recently approved CAR-T therapy targeting BCMA, representing a critical advancement in the treatment of multiple myeloma.

Janssen has also been active in conducting clinical trials and utilizing real-world evidence to ensure that its therapies meet the diverse needs of patients, thus strengthening its market position.

Competitive Analysis: Strategies and Market Dynamics

Innovation and Pipeline Strength:

BMS's pipeline is particularly strong in CAR-T therapies, which could offer new avenues for treatment in relapsed or refractory cases of multiple myeloma.

Janssen’s focus on developing a range of therapies, including monoclonal antibodies and oral medications, allows for a more comprehensive approach to treating multiple myeloma.

Market Access and Penetration:

BMS has made considerable progress in securing market access for its therapies, although it faces stiff competition from Janssen’s established products.

Janssen has capitalized on its extensive resources and distribution networks, ensuring that its therapies reach a broad audience of patients and healthcare providers.

Clinical Trials and Evidence-Based Approaches:

Both companies are heavily invested in clinical trials to expand indications and optimize treatment protocols. Janssen’s focus on combination therapies may yield faster results and greater patient satisfaction.

Future Prospects: Who Will Dominate the Market?

As we look to the future, both BMS and Janssen are poised to significantly influence the multiple myeloma treatment landscape. Several factors will determine which company emerges as the market leader:

Emerging Treatment Strategies: The introduction of new therapies and treatment combinations will shape clinician preferences and affect market dynamics.

Patient-Centric Initiatives: Companies that effectively address patient needs and ensure access to their therapies will likely gain a competitive advantage.

Regulatory Landscape: Timely approvals for new drugs and indications can shift the competitive landscape, providing an edge to the first movers.

Conclusion

The rivalry between BMS and Janssen in the multiple myeloma treatment market is intense, with both companies equipped to lead through their innovative therapies and diverse pipelines. While BMS is focusing on advancing its CAR-T cell offerings, Janssen’s extensive product range positions it for sustained growth. The next decade will be defined by breakthroughs in treatment options, improved patient accessibility, and the ability of these companies to adapt to the changing needs of healthcare providers and patients alike. As the battle for supremacy in the multiple myeloma treatment market unfolds, the industry will closely watch the developments from both BMS and Janssen.