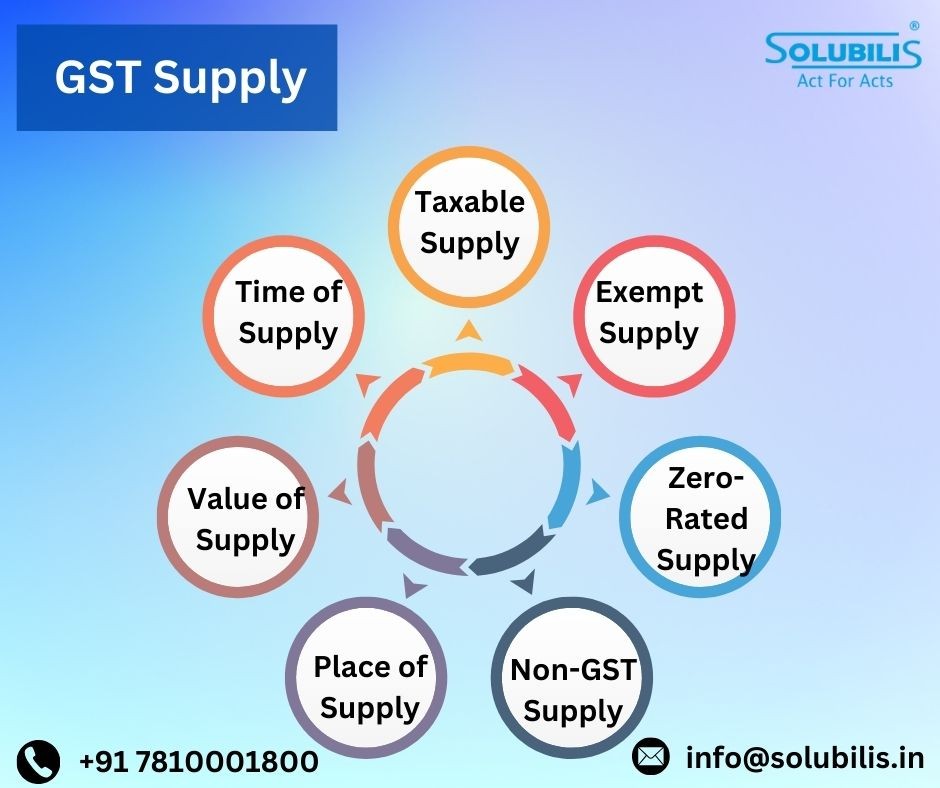

GST Supply

Under India's GST, "supply" covers transactions like sale, transfer, barter, rental, or lease of goods or services for consideration in business. Types include taxable, exempt, zero-rated, and non-GST supply. Time of supply defines tax due dates, value determines taxable amount, and place identifies whether CGST/SGST or IGST applies based on the location.

#gstsupply

https://www.solubilis.in/gst-r....egistration-in-banga