Tin(II) chloride, commonly referred to as stannous chloride, plays a vital role in various industrial applications, ranging from chemical synthesis to electroplating. As industries that rely on tin compounds continue to expand, particularly in sectors such as electronics, automotive, and pharmaceuticals, the demand for Tin(II) chloride has seen consistent growth. Consequently, the price dynamics of this compound are closely monitored by market participants. This report delves into the Tin(II) chloride price forecast, evaluating current trends, market drivers, challenges, and the future outlook for 2024 and beyond.

Forecast Report

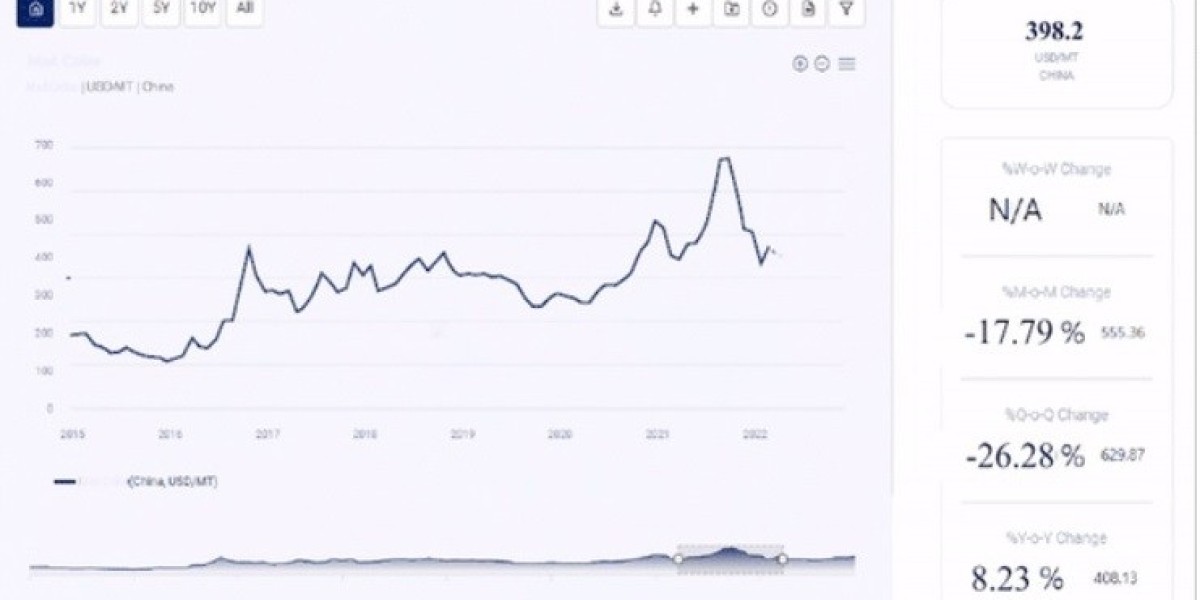

The price of Tin(II) chloride has historically been influenced by several key factors, including the availability of raw materials (specifically tin ore), energy costs, global demand, and geopolitical issues in major tin-producing regions. The price of Tin(II) chloride remained relatively stable but witnessed fluctuations due to supply chain disruptions and varying demand across industries. As we move into 2024, the outlook for Tin(II) chloride pricing is expected to be shaped by the following factors:

Request For Sample: https://www.procurementresource.com/resource-center/tin-ll-chloride-price-trends/pricerequest

Raw Material Supply: Tin is a finite resource, and the availability of tin ore has a significant impact on the price of Tin(II) chloride. Any disruption in the supply chain, such as reduced mining output or trade restrictions, can cause price spikes.

Industry Demand: Sectors such as electronics, chemicals, and pharmaceuticals are expected to drive demand for Tin(II) chloride. The rapid expansion of electric vehicles (EVs) and renewable energy technologies, which require tin-based components, is anticipated to create upward pressure on prices.

Global Economic Conditions: The global economy plays a crucial role in influencing the demand for industrial chemicals like Tin(II) chloride. A slowdown in global manufacturing or trade could temper price increases, while economic growth could push prices higher.

Energy Prices: Energy costs directly affect production expenses. A rise in global energy prices could translate to increased production costs for Tin(II) chloride manufacturers, which would, in turn, be reflected in the market price.

Based on these factors, industry analysts project a gradual increase in the price of Tin(II) chloride through 2024, with potential price surges depending on raw material supply stability. Current estimates suggest an average price growth of approximately 4-6% annually, with occasional fluctuations tied to specific market disruptions.

Market Analysis

The global Tin(II) chloride market is strongly linked to industrial growth, particularly in emerging economies. Key market regions, such as Asia-Pacific, North America, and Europe, have demonstrated varying levels of demand for the compound, influenced by both local manufacturing trends and global supply chain conditions.

Asia-Pacific: This region remains the largest consumer of Tin(II) chloride due to the high concentration of electronics manufacturing, automotive production, and chemical processing industries. Countries like China, Japan, and South Korea have established themselves as significant players in the market, driven by strong demand for electronics and electroplating applications. The rise in electric vehicle production in China is a particularly strong driver of Tin(II) chloride demand.

North America: The North American market is showing steady growth, driven by increased demand from the pharmaceutical and chemical sectors. The automotive industry, especially with the shift towards electric vehicles, also contributes to the demand for Tin(II) chloride in this region.

Europe: The European market has been relatively stable, with demand driven by sectors like electronics, chemicals, and automotive. The region's push for sustainability and renewable energy projects has fostered the use of tin compounds, including Tin(II) chloride, particularly in energy storage and related technologies.

Supply Chain Factors: The Tin(II) chloride market is highly sensitive to supply chain factors. Any disruptions in the supply of tin ore, whether due to geopolitical issues, mining difficulties, or regulatory changes, can significantly impact the availability and pricing of the compound. Additionally, the global shift towards environmentally sustainable mining practices has the potential to influence production costs.

Technological Advancements: The development of more efficient production techniques and the rising demand for high-purity Tin(II) chloride for specialized applications are expected to drive market growth. Innovations in manufacturing processes, particularly for pharmaceuticals and electronics, are likely to support steady demand growth.

Latest News

Recent developments in the Tin(II) chloride market have centered around supply chain adjustments, technological innovations, and shifts in demand patterns. Notable news from the sector includes:

Supply Chain Resilience: In response to the disruptions caused by the COVID-19 pandemic and subsequent global supply chain constraints, manufacturers have been focused on diversifying their tin ore sources. This is to prevent over-reliance on any single supplier or region, especially given geopolitical risks in key mining countries. Several companies have signed long-term supply agreements with tin producers in regions outside the traditional mining powerhouses to ensure a more consistent raw material supply.

Environmental Initiatives: The tin industry, including Tin(II) chloride production, has come under scrutiny for its environmental impact. Recent news highlights the increased adoption of sustainable mining practices and the development of more eco-friendly production methods. These innovations are aimed at reducing the carbon footprint of Tin(II) chloride production while maintaining high product purity and quality.

Technological Integration: As industries like electronics and renewable energy continue to evolve, the use of Tin(II) chloride in advanced technologies has gained attention. For instance, the compound is increasingly used in the production of solar panels and batteries, where tin-based materials contribute to improved performance and efficiency. Recent reports indicate ongoing research and development efforts aimed at enhancing the properties of Tin(II) chloride for such applications.

Electronics Market Growth: The growing demand for consumer electronics, coupled with advancements in semiconductor manufacturing, has positioned Tin(II) chloride as a critical material for the industry. Market reports suggest that as more countries adopt 5G technologies and develop infrastructure for IoT devices, the demand for Tin(II) chloride will remain strong.

Sustainability Concerns in Automotive: With the automotive industry moving towards greener technologies, particularly electric vehicles, the demand for tin compounds like Tin(II) chloride is on the rise. Recent industry news has focused on the integration of tin-based components in batteries and EV systems, signaling future demand growth in this sector.

Contact Us:

Company Name: Procurement Resource

Contact Person: Endru Smith

Email: sales@procurementresource.com

Toll-Free Number: USA & Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537 132103 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: https://www.procurementresource.com/