Bollinger Bands in Futures Trading

Introduction

Trading in futures can be a complex but rewarding endeavor. To make profitable decisions, traders use various tools and indicators. One of the most widely used tools in futures trading is Bollinger Bands. Whether you're a beginner or a seasoned trader, understanding how Bollinger Bands work can significantly improve your trading strategies.

But wait, what exactly are Bollinger Bands, and how can they help you succeed in futures trading? In this article, we’ll break it all down in simple terms, so you can start using them effectively. Along the way, we’ll also touch upon the importance of stock trading education and some of the best stock market courses , especially in India.

Discover how Bollinger Bands enhance futures trading strategies. Learn about stock trading courses India & the best stock market course for success.

1. What Are Bollinger Bands?

Imagine you're driving on a road with guardrails on both sides. The road represents the price movement of a futures contract, while the guardrails are the Bollinger Bands. These "guardrails" help you understand how far the price may move in either direction before it potentially reverses.

Bollinger Bands are a type of technical analysis tool used to measure market volatility. Created by John Bollinger in the 1980s, they consist of three lines: the middle band (a simple moving average) and two outer bands that are calculated based on market volatility.

2. History and Origin of Bollinger Bands

John Bollinger, a financial analyst and author, developed Bollinger Bands to address the need for a more adaptive volatility indicator. Before their introduction, many traders used fixed-width bands, but these didn't adjust based on market conditions. Bollinger's innovation allowed traders to gain a better understanding of volatility, thus enabling more accurate predictions of market behavior.

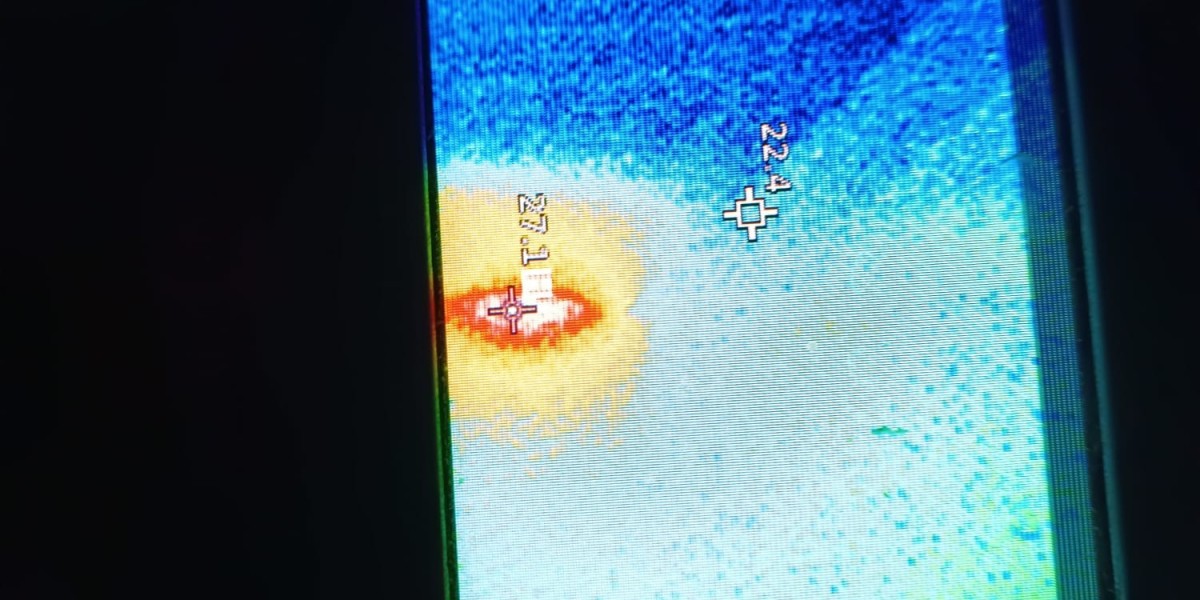

3. How Do Bollinger Bands Work in Futures Trading?

In futures trading, the aim is often to predict where the price of an asset is headed. Bollinger Bands help traders by offering a visual representation of the price’s volatility.

When the price moves toward the upper band, it may indicate that the asset is overbought and due for a pullback. On the other hand, when the price is near the lower band, it could be oversold and due for a bounce. The middle band often acts as a magnet, pulling the price back toward it after extreme movements.

4. Understanding the Middle Band

The middle band in Bollinger Bands is typically a 20-period simple moving average (SMA). Think of it as the “average” price of the asset over a specific number of days. When prices consistently hover around this band, the market is said to be in equilibrium.

Key Point:

The middle band helps you gauge whether the market is trending or ranging. Prices moving above the middle band may indicate an uptrend, while prices below suggest a downtrend.

5. Upper and Lower Bands Explained

The upper and lower bands are calculated using standard deviations from the middle band. The upper band typically represents a price level that is two standard deviations above the 20-period moving average, while the lower band is two standard deviations below.

Key Point:

The wider the gap between the upper and lower bands, the more volatile the market. Conversely, when the bands narrow, the market is less volatile.

6. Volatility and Its Impact on Bollinger Bands

Bollinger Bands are inherently tied to volatility. When the market is highly volatile, the bands will expand. In periods of low volatility, the bands contract. Understanding this relationship is crucial for futures traders, as large price swings often follow periods of low volatility.

7. Bollinger Band Squeeze: A Signal for Big Moves

A Bollinger Band Squeeze occurs when the upper and lower bands contract tightly around the price. This is often a sign that the market is poised for a significant move, either up or down.

Many traders use the squeeze as a signal to prepare for a trade, but it’s essential to combine it with other indicators to avoid false breakouts.

8. How to Use Bollinger Bands for Entry and Exit Points

One of the most practical uses of Bollinger Bands in futures trading is determining entry and exit points. For instance, a trader might decide to enter a position when the price bounces off the lower band, expecting it to revert to the middle or upper band.

Similarly, when the price touches or exceeds the upper band, it may be time to exit the position to lock in profits.

9. Combining Bollinger Bands with Other Indicators

While Bollinger Bands are a powerful tool on their own, they work best when combined with other indicators like Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). Using multiple indicators helps to confirm signals and reduce the risk of false readings.

10. Common Mistakes Traders Make with Bollinger Bands

It’s easy to misinterpret Bollinger Bands if you’re not careful. One common mistake is assuming that prices will always reverse when they touch the upper or lower band. The truth is, markets can stay overbought or oversold for extended periods, especially during strong trends.

11. The Importance of Stock Market Education

Before diving into complex trading strategies, it's crucial to have a solid foundation. This is where a quality course stock market can make all the difference. A structured course can teach you not only about Bollinger Bands but also other essential indicators and strategies to succeed in futures trading.

12. Best Stock Market Courses in India

If you're based in India and looking to enhance your trading skills, there are several stock trading courses that stand out. Some popular options include:

NSE Academy Certified courses of share market : This course offers in-depth training on stock market fundamentals, technical analysis, and trading strategies.

Bombay Stock Exchange (BSE) Institute: BSE Institute provides a range of professional courses for individuals looking to build a career in stock trading.

Nifty Trading Academy: Focuses specifically on technical analysis and trading strategies for the Indian market.

13. Real-Life Case Studies: Bollinger Bands in Action

Case studies can be incredibly enlightening. For instance, many traders use Bollinger Bands during earnings season in the futures market. By identifying squeezes and breakouts, they can capitalize on short-term volatility to make profitable trades.

14. Should You Use Bollinger Bands in Your Trading Strategy?

The answer depends on your trading style. Bollinger Bands are ideal for traders looking to identify market volatility and make short- to medium-term trades. If you combine them with other indicators and avoid common pitfalls, Bollinger Bands can significantly enhance your trading strategy.

Also read : Algorithmic Trading

15. Conclusion and Final Thoughts

Bollinger Bands are a versatile and powerful tool for futures trading, helping traders make informed decisions by understanding market volatility. However, like any tool, they work best when used correctly and in combination with other indicators.

Investing in a stock trading course, especially in India, can help you build a solid foundation and master tools like Bollinger Bands. Remember, no indicator is foolproof, but the more educated you are, the better your chances of trading success.

FAQs

1. What are Bollinger Bands used for in futures trading?

Bollinger Bands help traders gauge market volatility and identify potential entry and exit points in futures trading.

2. How do I interpret a Bollinger Band Squeeze?

A Bollinger Band Squeeze indicates a period of low volatility, often followed by a significant price movement.

3. Can Bollinger Bands be combined with other indicators?

Yes, combining Bollinger Bands with indicators like RSI or MACD can help confirm trading signals and reduce risk.

4. Are there good stock market courses available in India?

Yes, courses like NSE Academy Certified Stock Market Course and BSE Institute courses are highly recommended for traders in India.

5. Is it possible to trade futures successfully with just Bollinger Bands?

While Bollinger Bands are helpful, it's best to use them alongside other tools and strategies for optimal trading success.